As mentioned in the introduction, we will start with spatial models without price. We will add price dynamics later.

We use a 2-dimensional

![]() grid with periodic boundary

conditions. Sites are numbered

grid with periodic boundary

conditions. Sites are numbered ![]() . Each site belongs to a

cluster, denoted by

. Each site belongs to a

cluster, denoted by ![]() . Initially, each site belongs to

``itself'', that is,

. Initially, each site belongs to

``itself'', that is, ![]() , and thus cluster numbers also go from

, and thus cluster numbers also go from

![]() to

to ![]() .

.

The dynamics is such that in each time step we randomly pick a

cluster, delete it, and the corresponding sites are taken over by

neighboring clusters. Since the details, in particular with respect

to the time scaling, make a difference, we give a more technical

version of the model. In each time step, we first select a cluster

for deletion by randomly picking a number ![]() between

between ![]() and

and ![]() .

All sites belonging to the cluster (i.e.

.

All sites belonging to the cluster (i.e. ![]() ) are marked as

``dead''. We then let adjoining clusters grow into the ``dead'' area.

Because of the interpretation later in the paper, in our model the

``dead'' sites play the active role. In parallel, they all pick

randomly one of their four nearest neighbors. If that neighbor is not

dead (i.e. belongs to a cluster), then the previously dead site will

join that cluster. This step is repeated over and over, until no dead

sites are left. Only then, time is advanced and the next cluster is

selected for deletion.

) are marked as

``dead''. We then let adjoining clusters grow into the ``dead'' area.

Because of the interpretation later in the paper, in our model the

``dead'' sites play the active role. In parallel, they all pick

randomly one of their four nearest neighbors. If that neighbor is not

dead (i.e. belongs to a cluster), then the previously dead site will

join that cluster. This step is repeated over and over, until no dead

sites are left. Only then, time is advanced and the next cluster is

selected for deletion.

In physics this is called a domain coarsening scheme (e.g. [11]): Clusters are selected and deleted, and their area is taken over by the neighbors. This happens with a total separation of time scales, that is, we do not pick another cluster for deletion before the distribution of the last deleted cluster has finished. Fig. 1 shows an example. We will call a cluster of size larger than zero ``active''.

|

[width=0.4]basic-1-gz.eps

[height=0.4]basic-2-gz.eps

|

Note that it is possible to pick a cluster that has already been deleted. In that case, nothing happens except that the clock advances by one. This implies that there are two reasonable definitions of time:

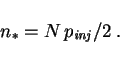

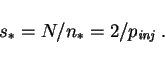

At any particular time step, there is a typical cluster size. In

fact, in cluster time, since there are

![]() clusters, the average cluster size as a

function of cluster time is

clusters, the average cluster size as a

function of cluster time is

![]() .

However, if one averages over all time steps, we find a scaling

law. In cluster time, it is numerically close to

.

However, if one averages over all time steps, we find a scaling

law. In cluster time, it is numerically close to

![]() where

where ![]() is the cluster size,

is the cluster size, ![]() is the number of clusters of

size

is the number of clusters of

size ![]() , and

, and ![]() is the number of clusters with size larger than

is the number of clusters with size larger than

![]() .

.![[*]](footnote.png) In natural time, the large clusters have more weight since time

moves more slowly near the end of the coarsening process. The result

is again a scaling law (Fig. 2 (left)), but with

exponents increased by one:

In natural time, the large clusters have more weight since time

moves more slowly near the end of the coarsening process. The result

is again a scaling law (Fig. 2 (left)), but with

exponents increased by one:

![\includegraphics[width=0.49\hsize]{basic-scaling-gpl.eps}](img40.png)

![\includegraphics[width=0.49\hsize]{rnd-inj-gpl.eps}](img41.png)

|

In view of evolution, for example in economics or in biology, it is

realistic to inject new small clusters. A possibility is to inject

them at random positions. So in each time step, before the cluster

deletion described above, in addition with probability ![]() we pick one random site

we pick one random site ![]() and inject a cluster of size one at

and inject a cluster of size one at ![]() .

That is, we set

.

That is, we set ![]() to

to ![]() . This is followed by the usual cluster

deletion. It will be explained in more detail below what this means

in terms of system-wide injection and deletion rates.

. This is followed by the usual cluster

deletion. It will be explained in more detail below what this means

in terms of system-wide injection and deletion rates.

This algorithm maintains the total separation of time scales between the cluster deletion (slow time scale) and cluster growth (fast time scale). That is, no other cluster will be deleted as long as there are still ``dead'' sites in the system. Note that the definition of time in this section corresponds to natural time.

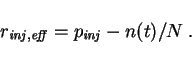

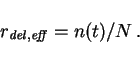

The probability that the injected cluster is really new is reduced by

the probability to select a cluster that is already active. The

probability of selecting an already active cluster is ![]() , where

, where

![]() is again the number of active clusters. In consequence, the

effective injection rate is

is again the number of active clusters. In consequence, the

effective injection rate is

The cluster size distribution for the model of this section is

numerically close to a log-normal distribution, see

Fig. 2 (right). Indeed, the position of the

distribution moves with ![]() (not shown). In contrast to

Sec. 3.1, this is now a steady state result.

(not shown). In contrast to

Sec. 3.1, this is now a steady state result.

It is maybe intuitively clear that the injection mechanism of the

model described in Sec. 3.2 destroys the scaling law from

the basic model without injection (Sec. 3.1), since

injection at random positions introduces a typical spatial scale. One

injection process that actually generates steady-state scaling is

injection along a 1-d line. Instead of the random injection of

Sec. 3.2, we now permanently set

In this case, we numerically find a stationary cluster size

distribution (Fig. 3 (right)) with

|

[width=0.4]snap-line-gz.eps

[width=0.55]line-scaling-gpl.eps

|

One could ask what would happen without space. A possible translation

of our model into ``no space'' is: Do in parallel: Instead of picking

one of your four nearest neighbors, you pick an arbitrary other agent

(random neighbor approximation). If that agent is not dead, copy its

cluster number. Do this over and over again in parallel, until all

agents are part of a cluster again. A cluster is now no longer a

spatially connected structure, but just a set of agents. In that

case, we obtain again power laws for the size distribution, but this

time with slopes that depend on the injection rate ![]() (Fig. 4); see Sec. 4.4 for

details.

(Fig. 4); see Sec. 4.4 for

details.

|

[width=0.49]nsptl-p10-gpl.eps

[width=0.49]nsptl-p01-gpl.eps

|

Fig. 5 shows actual retail company size distributions

from the 1992 U.S. economic census [12], using

annual sales as a proxy for company size. We use the retail sector

because we think that it is closest to our modelling assumptions --

this is discussed at the end of Sec. 6. We show

two curves: establishment size,

and firm size.![[*]](footnote.png) It is clear that in order to be comparable with our model

assumptions, we need to look at establishment size rather than at

company size.

It is clear that in order to be comparable with our model

assumptions, we need to look at establishment size rather than at

company size.

Census data comes in unequally spaced bins; the procedure to convert it into useable data is described in the appendix. Also, the last four data points for firm size (not for the establishment size, however) were obtained via a different method than the other data points; for details, again see the appendix.

From both plots, one can see that there is a typical establishment size around $400000 annual sales; and the typical firm size is a similar number. This number intuitively makes sense: With, say, income of 10% of sales, smaller establishments will not provide a reasonable income.

One can also see from the plots that the region around that typical

size can be fitted by a log-normal. We also see, however, that for

larger numbers of annual sales, such a fit is impossible since the

tail is much fatter. A scaling law with

![[*]](footnote.png)

This is, however, at odds with investigations in the literature. For

example, Ref. [13] find a log-normal, and

by using a Zipf plot they show that for large companies the tail is

less fat than a log-normal. However, there is a huge

difference between our and their data: They only use publicely

traded companies, while our data refers to all companies in the

census. Indeed, one finds that their plot has its maximum at annual

sales of ![]() , which is already in the tail of our distribution.

This implies that the small scale part of their distribution comes

from the fact that small companies are typically not publicely traded.

In consequence, it reflects the dynamics of companies entering and

exiting from the stock market, not entry and exit of the company

itself.

, which is already in the tail of our distribution.

This implies that the small scale part of their distribution comes

from the fact that small companies are typically not publicely traded.

In consequence, it reflects the dynamics of companies entering and

exiting from the stock market, not entry and exit of the company

itself.

We conclude that from available data, company size distributions are

between a log-normal and a power law with

![]() or

or

![]() . Further investigation of this goes beyond the scope of

this paper.

. Further investigation of this goes beyond the scope of

this paper.

|

[width=0.49]sales-loglog-gpl.eps

[width=0.49]sales-accum-gpl.eps

|